The way Americans handle money has changed dramatically in recent years. With smartphones becoming an essential part of daily life, digital wallets have emerged as the preferred payment method for millions. Whether shopping online, paying bills, or splitting dinner costs, digital wallets in the USA are redefining convenience, security, and speed in 2025.

A digital wallet (or e-wallet) is a mobile-based payment system that securely stores your financial information—like debit cards, credit cards, and even cryptocurrencies—to enable seamless transactions. With just a few taps, users can pay online or in-store without carrying cash or physical cards.

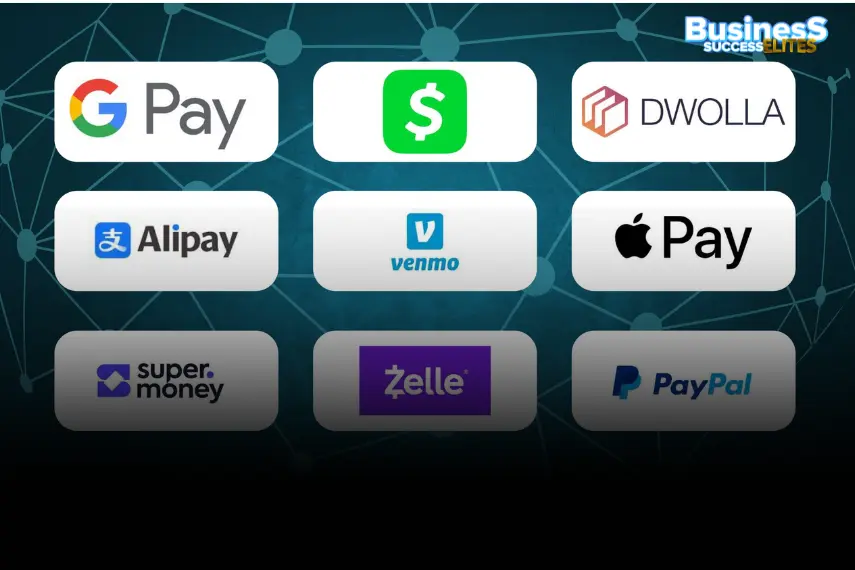

Apple Pay – The most popular wallet for iPhone users, offering fast and secure contactless payments.

Google Wallet – Works across Android and Wear OS devices, supporting tap-to-pay and online transactions.

PayPal – Trusted by millions, ideal for online purchases and international transfers.

Venmo – Social-friendly wallet perfect for peer-to-peer transfers.

Cash App – Combines payments, banking, and Bitcoin investing.

Samsung Wallet – Integrates payments, loyalty cards, and digital IDs for Android users.

Speed & Convenience: No more searching for cards—just tap and go.

Enhanced Security: Encrypted payments and biometric authentication make transactions safer than ever.

Rewards & Cashback: Many wallets offer loyalty points, cashback, and exclusive offers.

Seamless Online Shopping: Checkout is faster with saved credentials.

Contactless Culture: Post-pandemic, contactless payments are now mainstream.

Crypto Integration: More wallets now support Bitcoin, Ethereum, and stablecoins for everyday use.

AI-Based Fraud Detection: Machine learning helps detect unusual activity in real-time.

Unified Wallets: One app for payments, IDs, tickets, and loyalty cards.

Buy Now, Pay Later (BNPL): Integration of flexible payment options within digital wallets.

Cross-Border Payments: Instant international transfers at lower fees.

Despite their benefits, digital wallets face some hurdles:

Cybersecurity risks and phishing attacks remain threats.

Merchant adoption in small towns is still catching up.

Privacy concerns over data sharing and spending patterns.

However, with regulatory improvements and tech innovation, these challenges are being addressed rapidly

By 2030, experts predict that over 80% of transactions in the USA will be digital. With government support, fintech innovation, and evolving consumer behavior, digital wallets will likely become the default mode of payment across all sectors—from retail to healthcare.

Digital wallets are no longer just a convenience—they’re the foundation of a cashless, connected American economy. Whether it’s Apple Pay at your local coffee shop or PayPal for your online shopping, the way you pay in 2025 is smarter, faster, and more secure than ever before.

IPO-Bound PhonePe Focuses on Payments Growth and Platform Expansion

February 8, 2026