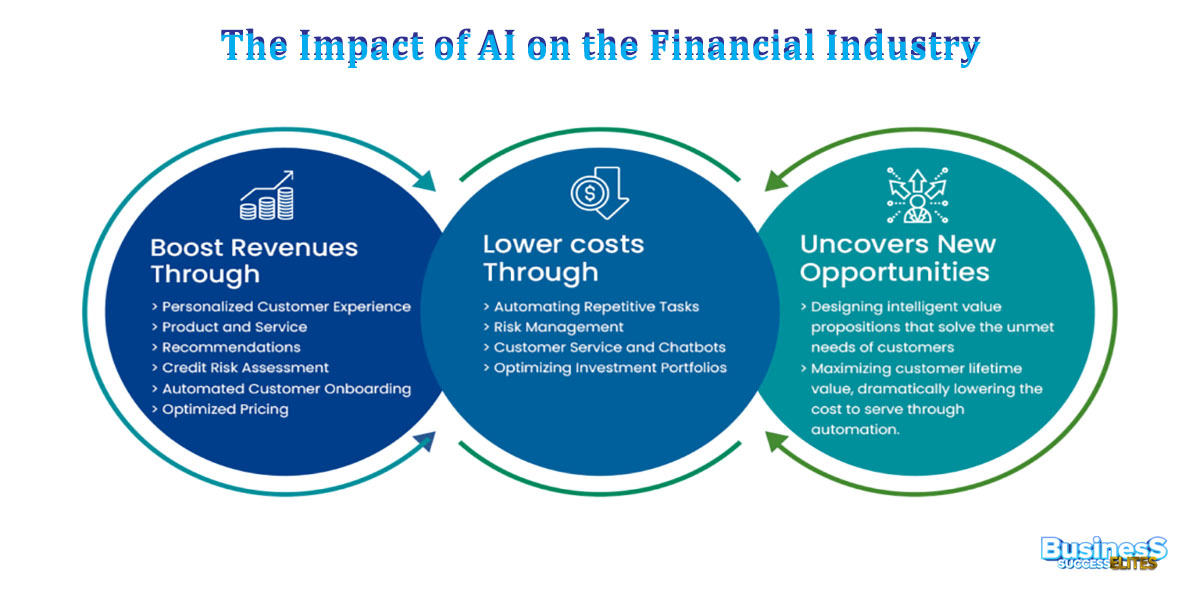

The Influence of AI on the Financial Sector: Revolutionizing Finance for Tomorrow. Artificial Intelligence (AI) has quickly emerged as a fundamental pillar of progress in numerous fields; however, the financial sector is particularly noteworthy. Although it serves multiple functions, AI primarily focuses on optimizing operations and improving customer interactions. This transformation is not without its hurdles, but it undeniably shapes how financial entities conduct business and cater to their clientele. In this discussion, we will delve into the significant effects of AI on finance, emphasizing its advantages, obstacles and potential future developments.

One of the most prominent effects (of AI in finance) is the significant enhancement of customer experience. Financial institutions are increasingly leveraging AI-driven chatbots and virtual assistants to provide support around the clock (24/7). These innovative tools can respond to common queries, guide users through transactions and even offer personalized financial advice—this is based on individual spending patterns. However, not only does this improve customer satisfaction, but it also alleviates the workload on human staff, allowing them to focus on more complex inquiries. Although the technology is still evolving, its impact is already evident in the industry.

Artificial Intelligence algorithms are proving to be invaluable in the identification of fraudulent activities. By analyzing vast amounts of transaction data in real-time, AI can detect unusual patterns and flag potentially fraudulent transactions for further investigation. This proactive approach to fraud detection not only protects customers (and their interests) but also helps institutions avoid significant financial losses. Moreover, AI plays a crucial role in risk management. By evaluating a multitude of factors—such as market conditions, economic indicators and historical data—AI systems can predict potential risks and advise on appropriate strategies. This capability is particularly vital in an ever-changing financial landscape.

Investment strategies and wealth management are undergoing a revolution due to AI, making them more data-driven and efficient. Algorithmic trading, which is powered by AI, can analyze market trends and execute trades at speeds that no human trader can match. This not only increases the chances of profit; however, it also minimizes the risk of human error. Although the technology is advanced, it raises questions about the implications for traditional trading practices. Because of this, the financial sector must adapt swiftly to keep pace with these innovations.

Furthermore, robo-advisors (1) are gaining significant traction, as they offer personalized investment advice that caters to individual risk tolerance and financial objectives. These platforms utilize AI to scrutinize user data and market conditions; however, they provide tailored recommendations without the exorbitant fees typically linked to conventional wealth management. This shift is noteworthy—because it democratizes access to financial guidance, many individuals can now invest wisely (2) in a way that was previously reserved for the affluent. Although some may question the effectiveness of automated tools, the growing popularity of these services suggests a notable change in investor behavior.

AI (artificial intelligence) streamlines numerous operational processes within financial institutions. It automates routine tasks—such as data entry and compliance checks—however, it also optimizes supply chain management. Consequently, AI reduces costs and increases efficiency. This (enhancement) allows financial organizations to allocate resources more effectively, which in turn boosts productivity and improves service delivery. Although some may be skeptical of AI’s role, its potential benefits are evident, but challenges remain.

The financial industry is subject to extensive regulations; however, maintaining compliance can prove to be a formidable challenge. AI (artificial intelligence) offers assistance in this domain by automating compliance checks, as well as monitoring transactions for adherence to established regulations. Because institutions utilize AI to analyze compliance data, they can identify potential risks and rectify issues before they escalate. This proactive approach ultimately helps safeguard against significant fines (which can be detrimental) and reputational damage. Although the benefits are clear, the implementation of such technologies requires careful consideration.

Challenges and Considerations

Although the benefits of AI in finance are significant (indeed, they can enhance efficiency), there are challenges that must be considered. Concerns regarding data privacy and security are paramount; financial institutions must handle sensitive information with care. However, the reliance on AI can raise questions about transparency and accountability. Institutions must, therefore, ensure that their AI systems are interpretable (this is crucial) and that decisions made by algorithms can be explained.

The Future of AI in Finance

As AI technology (which continues to evolve) progresses, its impact on the financial industry is anticipated to expand. The integration of machine learning, natural language processing and predictive analytics will (in fact) further enhance the capabilities of financial institutions. Companies that embrace AI will likely gain a competitive edge; offering improved services and innovative solutions that meet the changing needs of consumers. However, this transformation is not without challenges, because it requires careful consideration of ethical implications. Although the potential benefits are significant, the complexities involved cannot be overlooked.

Conclusion

AI is, without a doubt, reshaping the financial sector (1) by driving efficiency and enhancing customer experiences. However, it is also improving risk management. As we gaze toward the future, it becomes evident that the incorporation of AI will further redefine finance (2), paving the way for smarter and more responsive financial services. Although challenges persist, the potential rewards are significant. This makes it an exhilarating time for both consumers and institutions within the realm of finance, because the landscape is evolving rapidly.

The Best Wicket Keeper in the World (2026 Edition)

February 24, 2026